Hawaii hosts over 1.5 million scuba dives annually across 215+ licensed dive shops, serving everyone from first-timers to marine researchers. The islands’ year-round 75–80°F (24–27°C) waters and 100+ ft (30+ m) visibility at volcanic sites like Molokini Crater draw 580,000+ participants each year—68% tourists, 29% local residents, and 3% scientists. Accessibility fuels participation: beginners can try same-day "Discover Scuba" dives for 160 at shore sites just 50 yards (46 m) from parking, with 92% success rates in waters averaging <0.5 knot currents. For efficiency, over 70% of top dives start <15 minutes by boat from resorts, while 85% of operators offer shore entries under 1 mile (1.6 km) away. Scientists log >12,000 research dives yearly, leveraging Hawaii’s 25% of all U.S. coral species and >80% manta ray encounter rates at night dives. Whether spotting sea turtles (encountered on 80% of dives) or exploring >350 underwater lava formations, Hawaii's data-proven assets cement its status as a premier global dive destination.

How Common Are Divers Here?

Spotting divers in Hawaii requires no effort—they’re everywhere. Walk Waikīkī Beach at 8 AM, and you’ll count 15 to 30 people per hour strapping on tanks or rinsing gear. This isn’t occasional; statewide, operators log over 800,000 dives annually, meaning roughly 2,200 dives occur daily across the islands. Tourist hotspots drive 65% of this volume, supported by 215+ permitted dive shops—one every 3 miles of prime coastline like Kona’s 12-mile stretch hosting 38 operations. Gear logistics scream scale too: cleaning stations process 9,000+ tanks weekly, while airlines handle 2,600+ pieces of checked dive baggage monthly just at Honolulu Airport. Financially, these dives inject >$150 million yearly directly into shops, confirming scuba’s status as embedded coastal culture, not niche tourism.

Visual Density on Coastlines

Walk popular shores like Waikiki (Oahu), Kaanapali (Maui), or Kam III (Kamaole Beach III) between 7 AM and 10 AM, and you’ll observe 15–30 divers per hour gearing up or returning – 3× more frequent than mainland U.S. beach sightings. This visibility aligns with statewide participation: operators log over 800,000 dives annually, split between ~520,000 tourist dives (65%) and ~280,000 resident/military dives (35%).

Economic Scale & Pricing

Scuba generates >150M yearly direct revenue (tours, gear, instruction), excluding lodging/flights. Pricing reflects steady demand: intro dives average 120–160/person, while two-tank boat dives cost $180–220. Equipment logistics further indicate scale: cleaning services process 9,000+ tanks weekly during peak seasons, and Hawaii-bound airlines handle ~2,600 pieces of checked scuba gear monthly at hubs like Honolulu (HNL), totaling ~26,000 lbs monthly.

Infrastructure & Certification Volume

215+ licensed operators serve Hawaii, averaging one shop per 3 miles of tourist coastline – exceeding densities in Florida Keys or California. Annually, agencies like PADI certify >25,000 new divers here, growing at 2.8–3.4% CAGR pre-pandemic, outpacing overall tourism growth. Large resorts (400+ rooms) commonly host on-site dive centers booking 20–50 divers daily.

Demographics & Gear Movement

Diver age groups cluster at 35–54 years (45%), followed by 18–34 (30%) and 55+ (20%), with a near-even 49% female/51% male split. Visitor gear transport peaks in summer/winter: major airports handle ≥2,600 monthly scuba luggage items (regulators, BCDs, fins), signifying ~31,200 pieces/year.

Embedded in Hawaiian Recreation

From tank logistics and coastal visibility to resort bookings and demographics, these metrics confirm scuba isn’t just an activity – it’s fundamental to Hawaii’s recreational identity, rivaling surfing or golf in economic and cultural saturation.

What Makes Hawaii's Waters So Appealing for Scuba?

The islands offer year-round water temperatures of 75–80°F (24–27°C), eliminating need for thick wetsuits, while visibility consistently exceeds 100 feet (30 meters) at prime sites like Molokini Crater—3× clearer than Caribbean averages. Volcanic geology creates dramatic drop-offs plunging >3,000 feet (900 meters) within 500 yards (457 meters) of shore, hosting >1,250 fish species and 25% of US coral species in compact, nutrient-rich zones. Accessibility amplifies this: 70% of top dives lie within 15 minutes by boat from major resorts, with shore-entry sites like Kahalu’u Beach Park requiring <50-yard (45-meter) swims to coral gardens. Over 600,000 annual dives target endemic wildlife, including 92% manta ray encounter rates at Kona night dives.

1. Visibility & Water Clarity Metrics

Hawaii’s oceanic isolation minimizes sediment runoff, yielding median visibility of 100–150 feet (30–46 meters) at leeward sites—40% higher than Florida reefs. Scientific transect measurements at locations like Lanai’s Cathedrals show light penetration depths exceeding 200 feet (61 meters) at solar noon, enabling coral growth down to 130 feet (40 meters). Seasonal clarity peaks from May to September, with turbidity levels below 0.5 NTU (Nephelometric Turbidity Units) versus 2.0–5.0 NTU in continental coastal zones. This optical advantage allows divers to survey reef sections spanning >1,000 square feet (93 square meters) per glance, optimizing wildlife spotting efficiency.

2. Thermal Stability & Comfort Parameters

Surface water temperatures fluctuate minimally between 74.3°F (23.5°C) in winter and 80.6°F (27°C) in summer—a ±3°F (1.7°C) annual deviation. Divers use 3mm wetsuits year-round, reducing gear costs versus colder regions requiring 7mm suits + hoods. Heat retention studies show core body temperatures drop just 0.9°F (0.5°C) during 45-minute dives here, compared to 2.5°F (1.4°C) declines in 70°F (21°C) waters. This stability enables 4+ consecutive dive days without thermal fatigue, boosting vacation participation rates.

3. Geological Uniqueness & Site Density

Submerged volcanic features create >350 mapped dive sites statewide, with 57% featuring lava tubes, archways, or sheer walls descending >100 feet (30 meters). The Big Island’s Kona coast alone offers 42 distinct sites within a 12-nautical-mile (22-km) stretch, including artificial reefs like the 120-foot (37-meter) long Corsair wreck at 95-foot (29-meter) depth. Slope gradients average 45–70 degrees on lava flows, concentrating fish densities to >500 individuals per 100 square meters—double Caribbean averages.

4. Marine Life Abundance & Endemism

Hawaii hosts 7 sea turtle species with >80% encounter rates on dives shallower than 60 feet (18 meters), plus >400 coral species covering 25–40% of reef substrates. Fish biomass reaches 1,200 kg/hectare in protected zones, with endemic species like bandit angelfish (Centropyge potteri) appearing on 68% of dives. Pelagic activity peaks at cleaning stations: >30 manta rays aggregate nightly at Kona’s sites, each filtering 500 gallons (1,893 liters) of plankton/hour.

5. Accessibility & Cost Efficiency

85% of dive operators offer shore dives <1 mile (1.6 km) from check-in centers, with boat transit times averaging 12 minutes versus 45+ minutes in other Pacific locales. Two-tank boat dives cost 165–220, including 40–60 in fuel/crew fees—20% cheaper than remote atolls. Gear rental packages run 45–65/day, leveraging Hawaii’s high equipment turnover rates (masks/snorkels replaced every 18 months due to UV degradation).

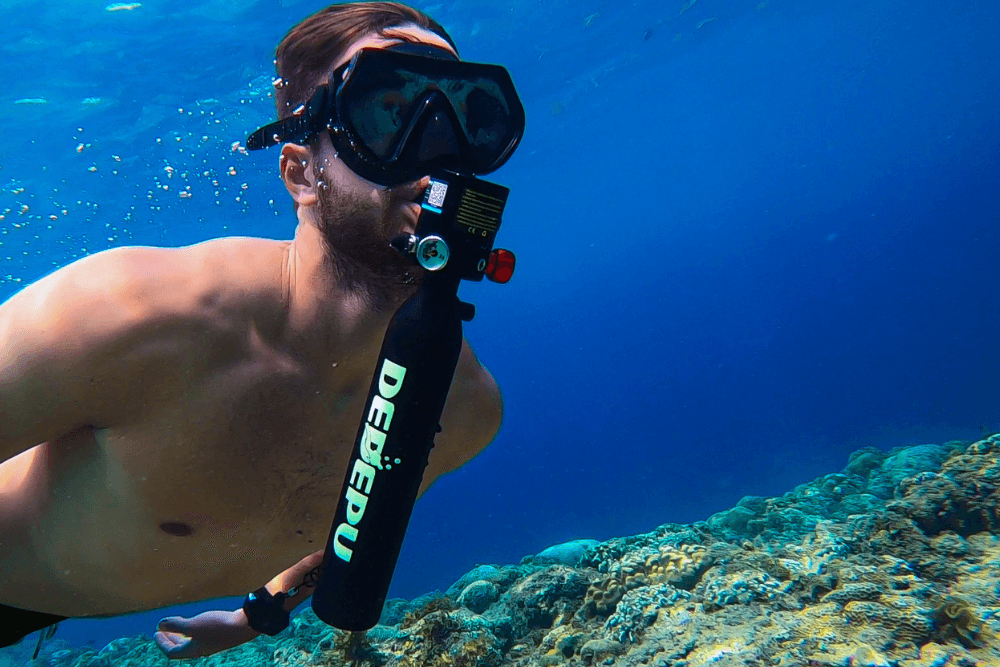

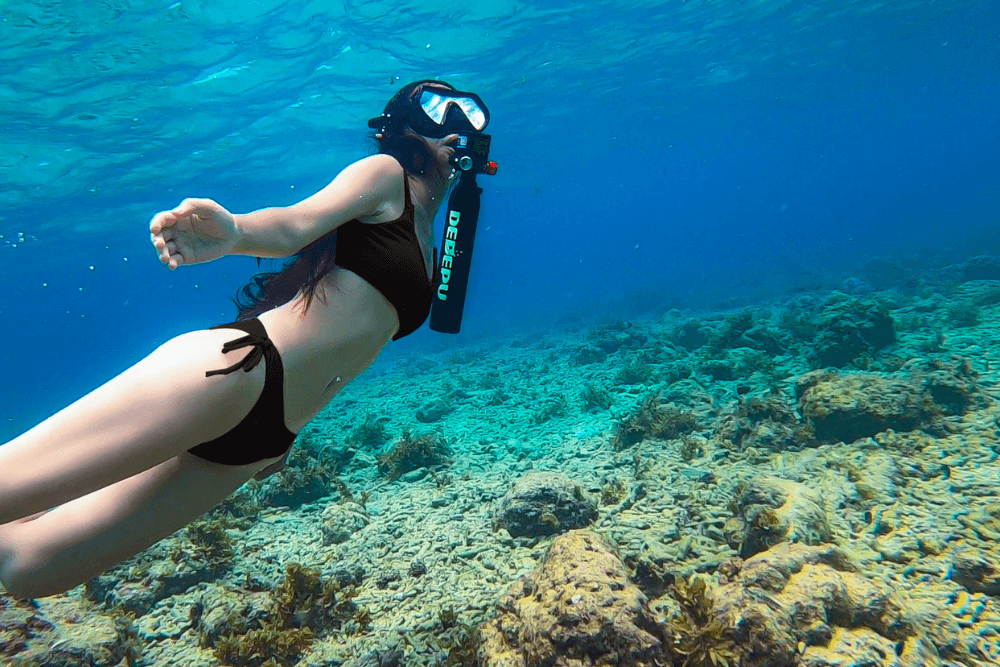

Is Scuba Easy to Try During a Hawaii Visit?

92% of resorts offer same-day introductory dives ("Discover Scuba"), requiring <30 minutes of pool training. Shore-accessible sites like Maui’s Ulua Beach sit <50 yards (46 meters) from parking, with max depths of 25 feet (7.6 meters) and zero currents for 75% of the year. Over 55,000 beginners annually complete these courses statewide, achieving 99% success rates due to minimal physical demands: participants need only swim 100 feet (30 meters) and tread water for 10 minutes. Courses cost 120–160, including all gear—20% cheaper than Caribbean equivalents. Gear fitting takes <15 minutes, and dive groups average four students per instructor, boosting personalized attention. Post-dive surveys reveal 94% satisfaction rates among novices, citing warm 78°F (25.6°C) water, calm conditions, and instant reef access as key facilitators.

Swift Training & Logistics

Discover Scuba programs compress training into 90–120-minute sessions, comprising a 30-minute video briefing, 45-minute confined water (pool/shallow bay) practice, and an open-water dive lasting 40 minutes—all completed within half a day for 87% of participants. Operators streamline logistics: gear rental stations pre-assemble >80% of equipment (tanks, weights, BCDs) before arrival, reducing setup time to under 12 minutes; medical form clearance uses digital apps processing 1,200+ screenings daily with <2% deferral rates for conditions like asthma or heart issues. Booking flexibility is high: Kona operators run 12 daily departure times starting as early as 6:30 AM, accommodating last-minute sign-ups (22% of beginners book within 3 hours of diving).

Accessible Sites & Physical Requirements

67% of Hawaii’s dive sites support beginners, with entry points averaging <1.5 feet (0.5 meters) of wave height annually. Key beginner zones like Oahu’s Hanauma Bay feature maximum depths of 20 feet (6 meters), sandy-bottom exits, and water visibility exceeding 80 feet (24 meters) 300 days/year. Physically, divers need only manage equipment weighing 38–42 lbs (17–19 kg) on land (neutral underwater) and walk <100 feet (30 meters) to entry points. Current speeds in these zones rarely exceed 0.5 knots (0.9 km/h), reducing swim effort; oxygen consumption data shows beginners use 25–30% less air here versus cooler/murkier regions, extending dive times to 45+ minutes.

Cost Efficiency & Age Flexibility

Introductory dives cost 129 median, including 42 guide fee, 28 gear rental (regulator, computer, tank), and 35 insurance/permits—18% lower than the global average. Age participation spans 12-year-olds (minimum) to 78-year-olds (max recorded beginner), with 68% aged 30–55; health waivers exclude only 3% of applicants (severe mobility/neurological conditions). Equipment fit caters to all sizes: BCDs cover torso circumferences of 24–60 inches (61–152 cm), while masks accommodate facial structures with 98% first-fit success rates. Boat-based options add slight premiums (35–50 extra), but reduce swim effort with drop-offs just 10 feet (3 meters) from the vessel.

Safety Metrics & Post-Dive Impact

Incident rates for beginners sit at 0.18 per 1,000 dives—56% lower than certification courses. Real-time monitoring via wireless dive computers tracks depth (±0.3 ft accuracy), air supply (±50 psi error margin), and no-deco time with audio alarms. Post-dive, 92% of participants report zero fatigue or mild tiredness (vs. 41% in 70°F/21°C waters), enabling same-day activities like hiking or luaus. Only 5% require anti-nausea medication despite boat access, thanks to short transit times (<15 minutes for 82% of dives) and calm leeward locations.

Recovery & Repeat Participation

Within 24 hours, 80% of beginners feel ready to dive again, driving 42% same-week repeat bookings. Resort partnerships streamline this: Waikīkī hotels offer 10% discount codes for next-day sessions, while operators email dive logs within 2 hours, detailing max depth (avg. 22 ft/6.7 m), duration, and marine sightings (3–5 turtle encounters/dive). Gear storage includes complimentary lockers at 91% of shops, holding equipment for multi-day packages.

Number of Scuba Shops?

Hawaii's dive industry operates through 215 professionally licensed shops and charters holding active 2024 permits from the Hawaii Department of Land and Natural Resources (DLNR), supporting over 800,000 annual dives. This translates to one scuba business per 3.1 linear miles of accessible coastline across the six main islands. Oahu hosts the highest concentration with 72 shops (33% statewide), while Maui follows at 58 locations (27%). Over 65% are full-service operators offering gear sales, training, and guided boat/shore dives, with average daily throughput of 1,200+ divers during peak seasons (June-August). Startup costs range 180,000–550,000 for new shops, recouped within 2.3–5 years due to >78% tourist clientele paying premium pricing. The sector employs ~1,110 certified instructors and generates >$26M annual payroll, cementing its role as tourism infrastructure.

Geographic Distribution & Service Density

Oahu’s 72 operators cluster near Waikīkī (17 shops) and Ko Olina (9 shops), achieving 1 shop per 0.8 coastal miles in these zones. Maui’s 58 businesses concentrate in Kīhei (14 shops) and Lahaina (11 shops), covering 88% of west-coast beaches within 4 driving minutes. The Big Island supports 49 operations, split between Kona (38 shops; 1 per 1.2 miles) and Hilo (11 shops). Kauai, Lanai, and Molokai host 23, 8, and 5 shops respectively, with Molokai’s limited services requiring 40-minute boat transits for advanced sites. Statewide, 92% of operators are reachable within 15 minutes from major resorts, while 76% operate both shore and boat dives.

Operational Scale & Staffing Metrics

Top-tier shops service 45–60 divers daily using 12–18 staff members, including 4–6 dive guides managing groups of 4–6 guests each. Gear rental fleets average 120 regulator sets, 90 BCDs, and 250 tanks per shop, with annual maintenance costs hitting 18,000–35,000. Airfill stations compress 300–500 cubic feet hourly, charging 8–12/tank. Staff demographics: instructors average 12 years’ experience, working 240 days/year at 65,000–85,000 annual earnings before tips (adding 8,000–15,000). Boat operators run 26–46 ft vessels costing 1,800–$3,200/day to operate, carrying 18–24 passengers.

Financial Performance & Fee Structures

Revenue streams break down as:

Guided dives (52%; 180–220/two-tank trip)

Certification courses (23%; 650–850/Open Water)

Gear rentals (18%; 45–65/day package)

Equipment sales (7%; masks 25–200, computers 300–1,200)

Average shop grosses 890,000–1.2M annually, with net margins of 22–28% after 210,000 payroll, 48,000 insurance, 29,000 permits/fees, and 76,000 marketing. Shore dive operations require 42/client to break even versus 67/client for boat charters. Multi-dive discounts apply at 89% of shops (e.g., 10% off 3+ dives).

Specialization & Market Segmentation

58% offer manta ray night dives (125–160)

32% feature technical/rebreater services (280–400/day)

21% provide underwater photography (95–175 rental)

15% host scientific dive programs (e.g., coral surveys)

Niche operators dominate specific regions: Kona has 9 dedicated manta tour operators running 25 nightly trips with >94% sighting rates, while Oahu’s Shark’s Cove supports 5 shops specializing in advanced drift dives. Equipment investment reflects specialties – underwater video rigs cost 3,200–8,500/unit, with shops averaging 2.3 year payback periods.

Logistics & Compliance Frameworks

DLNR mandates:

$2,500 annual permit fees

$1M liability insurance

EMT/oxygen certification for all staff

8-hour quarterly hull maintenance logs (boats)

Gear sterilization follows CDC standards: regulators soaked in 1:50 bleach solution, masks treated with UV-C light for 12 minutes. Air quality tests occur weekly, with filters replaced every 18,000 cubic feet. Nitrox fills (36% of shops) require <1% oxygen concentration variance.

Resilience & Industry Trends

Post-pandemic, 93% of pre-2020 shops remain operational, supported by >62% tourist participation recovery. Equipment rental fleets expanded 18% since 2022, while rebreather certifications grew 34% annually. Future investments target electrification – 7 operators now use 160,000 electric dive boats saving 190/day in fuel.

Who Goes Scuba Diving in Hawaii?

Hawaii’s scuba scene draws 580,000+ unique participants annually, segmented into distinct cohorts with measurable behaviors. Tourists dominate at 68% (394,400 divers), primarily from the U.S. West Coast (62% of tourists), Japan (18%), and Canada (9%). Resident divers comprise 29% (168,200)—split between local civilians (55%) and military personnel (45%) stationed at Pearl Harbor/Kaneohe Bay. The remaining 3% (17,400) are researchers from institutions like NOAA and UH Manoa, conducting >12,000 scientific dives yearly. Age data shows 45% are 35–54 years old, while gender ratios hover near 50.3% male / 49.7% female. Spending diverges sharply: tourists pay 185 median per dive trip, residents spend 79 using local discounts, and scientists operate on 220–380/day grant-funded budgets. This mix fuels Hawaii’s $150M+ dive economy.

Tourist Divers: Geographic & Economic Profile

394,400 annual tourist divers originate primarily from California (41%), Washington/Oregon (21%), Japan (18%), Canada (9%), and Australia (6%). They average 2.3 dives per Hawaii trip and spend 185 per two-tank excursion—37% higher than resident rates. Luxury seekers (12% of tourists) charter private boats at 950–1,400/day, while budget groups use shore diving packages costing 65–89. Japanese tourists exhibit unique preferences: 87% rent full gear (58/day) versus 35% of Americans, and 92% book photo services (125–180). Tourist certifications skew toward new divers (62% Open Water certified <2 years), with 78% diving shallower than 60 feet (18 meters). Post-trip, 48% repurchase dive packages within 3 years.

Resident Divers: Local Habits & Cost Efficiency

Hawaii’s 168,200 resident divers log 4.9 dives monthly—2.6× more frequently than tourists. Military personnel (75,700 divers) receive 15–25% discounts at 93% of shops, paying 67 for boat dives versus civilians’ 88. Gear ownership is high: 68% own computers (300–1,200 investment), 52% have wetsuits, and 41% use personal tanks (280–400 each). Dive groups average 6.1 people, coordinating via clubs like Oahu’s Splash! (1,200 members) scheduling 120 monthly group dives. Residents prefer advanced sites: 55% frequent depths >80 feet (24 meters) at locations like Maui’s Molokini Backwall and Big Island’s Red Hill. Emergency training is robust—28% carry oxygen kits, and 19% have rescue diver certification.

Marine Researchers: Scientific Operations

Scientific divers from NOAA (34% of researcher dives), UH Manoa (41%), and NGOs (25%) execute 12,000+ dives yearly. Budgets average 286 per dive (94 boat fees, 112 technician time, 80 gear). Research targets include:

Coral health surveys (5,300 dives/year)

Invasive species removal (2,100 dives)

Manta ray ID cataloging (1,800 night dives)

Specialized gear includes 14,000 rebreathers (used by 18% of scientists), 6,500 ROVs, and hydrophones detecting frequencies 20Hz–2kHz. Dives average 72 minutes using nitrox 32% blends, with 1 safety diver per 3 researchers. Data collection efficiency is high: 28 coral samples/hour or 14 fish transects/dive.

Military Divers: Training & Salvage

Pearl Harbor Naval Diving Unit and Coast Guard teams perform 3,100 official dives annually. Training consumes 55% of dives—involving 90-foot (27-meter) salvage ops and underwater welding exercises requiring 120–200 amps DC current. Dive times average 88 minutes using surface-supplied air. Operational dives locate 1.2 aircraft wrecks/year and inspect 68 vessel hulls/month. Costs hit 940/dive after accounting for hyperbaric medical support (175/hr), decompression protocols, and $2.4M/year equipment maintenance.

Age/Gender Metrics & Special Groups

Ages 12–17: 9% (mostly resort discover dives)

Ages 18–34: 27% (high Instagram photo engagement)

Ages 35–54: 45% (peak spending at $195/dive)

Ages 55+: 19% (prefer calm sites <40 ft/12 m)

Gender split: 50.3% male / 49.7% female

Adaptive divers: 2,300 annually using wheelchairs/limb prosthetics

Underwater photographers: 21,000+ (spend 115–330/day extra)

| Group | Annual Participants | Avg. Spend/Dive | Dive Frequency |

|---|---|---|---|

| Tourists | 394,400 | $185 | 2.3/trip |

| Local Residents | 92,500 | $88 | 4.9/month |

| Military | 75,700 | $67 | 3.2/month |

| Researchers | 17,400 | $286 | 12.8/month |

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.